The latest news stories and stories of interest in the Willamette Valley from the digital home of Southern Oregon, from Wynne Broadcasting’s WillametteValleyMagazine.com

Thursday, April 7, 2022

Willamette Valley Weather

Today– Sunny, with a high near 75. Calm wind becoming north northwest around 6 mph in the afternoon.

Friday– A 50 percent chance of showers, mainly before 11am. Mostly cloudy, with a high near 57. Light and variable wind becoming west 5 to 9 mph in the afternoon.

Saturday– A 40 percent chance of showers. Snow level 2000 feet rising to 2500 feet in the afternoon. Partly sunny, with a high near 53. Calm wind becoming west northwest 5 to 8 mph in the afternoon. New precipitation amounts of less than a tenth of an inch possible.

Sunday– A 40 percent chance of showers. Snow level 1500 feet rising to 2000 feet. Mostly cloudy, with a high near 51.

Monday– A chance of rain, then showers likely and possibly a thunderstorm after 11am. Snow level 1500 feet rising to 2000 feet in the afternoon. Mostly cloudy, with a high near 50.

Lane County Public Health Officials Urging Residents to Get Vaccinated Before World Athletics Championships Start

Before one of the largest athletic events on Earth takes over Hayward Field on the University of Oregon campus, local public health officials are urging the public to get vaccinated. The World Athletics Championships start in less than 100 days.

And not just against COVID-19 —— “Depending on what vaccine you look at – measles, mumps, and rubella, diphtheria, tetanus, pertussis, polio, etc. – our vaccine rates are down 10, 15, 20%,” said Dr. Patrick Luedtke with Lane County Public Health. “We increased a little bit here and there but we also have significant drops over all of last year. Vaccine rates across the board haven’t returned to pre-pandemic levels.

Lane County’s medical community urges the public to get vaccinated before the Worlds. “Early in the pandemic, there was this real reluctance to go to a doctor’s office,” said Dr. Bob Pelz with PeaceHealth.

But the vaccines in question protect against very contagious diseases. “If you come into contact with somebody with measles, you’ve got about a 90% chance of getting infected if you’re not vaccinated,” Pelz said. “It’s highly, highly contagious. It travels with these tiny particles that can infect people several rooms away in a hospital.”

That could cause problems in a venue like Hayward Field. “They’re infectious. They’re contagious for a week before they even get a rash, so they could be coughing and not know that they’re spreading measles for days and days,” Pelz said, “and when people are gathering in large crowds like you’re describing, you could have a huge outbreak.”

Public Health says their clinics and other providers are stocked with the necessary shots.

“Anyone can search out one of those sites that has immunizations near them and can get vaccinated there,” Luedtke said. The federal government’s vaccines for children program pays for all vaccines for children under 18.

PeaceHealth has Eugene locations at

- 3299 Hilyard St

- 2484 River Rd.

- 3321 W 11th Ave.

Other pharmacies include:

- CVS Pharmacy, 4575 W 11th Ave

- Safeway Pharmacy, 350 E 40th Ave

- Rite Aid Pharamcy, 57 W 29th Ave

- Albertsons Pharmacy, 3075 Hilyard St

Eugene Police Release Name of Motorcyclist Who Died in Crash

The motorcyclist who died in a crash on Monday has been identified by Eugene Police as Dylan Roberts, 18, of Veneta.

The driver of the Nissan Altima sedan, Jose Bernardo Delgadillo Zacarias, 46, of Eugene was taken to a hospital with non-life threatening injuries.

Police said the crash happened when a Kawasaki ZR8 motorcycle crashed into the side of a Nissan Altima sedan leaving a credit union at West 11th Avenue and Bailey Hill Road in Eugene. Police said they believe speed was a contributing factor in the crash.

Telephone Outage Affecting 911 Service in Douglas County

DOUGLAS COUNTY, Ore. – The Douglas County Sheriff’s Office has been notified by Lumen Technologies & Reliance Connect of a telephone service and disrupting the ability of those affected to dial 9-1-1 from their landline telephones. The outage began roughly around 7:18 am on Wednesday, April 6, 2022.

Residents in the communities of Drain, Yoncalla, Elkton and Scottsburg are experiencing the effects of the telephone service outage. Residents who have cellular telephone service may be able to dial 9-1-1 from their cellular telephone to summon emergency services.

At this time, the telephone providers are unable to provide an estimated time of repair. Douglas Co. Sheriff’s Office

Linn County Sheriff Asking Public’s Help Identifying Body Left In Harrisburg Cemetery

The Linn County Sheriff’s Office is asking for the public’s help in identifying the body of a man left at a rural cemetery in the Harrisburg area.

The body was discovered on March 31, according to a news release from the agency.

Deputies responded to a report of a suspicious wooden box at a cemetery in the 24000 block of Powerline Road, and discovered that the box appeared to be a hand-built casket left behind a tree.

Investigators spoke with the board of directors for the cemetery, who stated there were no scheduled burials and they could not explain why a casket was left at the location, the news release states.

The man’s body had no obvious signs of trauma, according to the news release.

The unidentified man is described as a white adult between 30 to 60 years old, 5-foot-10, weighing 350 pounds and with brown and gray hair. He wore size 10.5 shoes and had a healed surgery scar on his lower back.

The investigation is ongoing. Linn County Detectives are working in conjunction with Oregon State Medical Examiner’s Office to determine the identity and cause of death of the deceased. Anyone with information is asked to contact the Detective Division (541) 967-3950.

Eugene Springfield Fire Officials Warn of Man Impersonating Fire Marshal Inspector

Eugene Springfield Fire officials are spreading the word after a person pretended to be a representative with the Fire Marshal’s Office this week.

It happened at about 4:30 p.m. on Monday at a bank in Eugene. Officials said the person told employees at the business they were from the Fire Marshal’s Office and were there to complete an inspection.

An employee called the office to verify the man’s identity and learned he was an imposter. Officials advised the employee to call police for help. The person got away before the police arrived and up to this point, officials said they have not received a description.

“Whether we’re responding to an emergency or doing our fire prevention or enforcement work. We garner a lot of trust from the community,” said Mike Caven, Deputy Chief of Operations for Eugene-Springfield Fire. “It’s incredibly important to us to make sure the public trusts us and knows what to look for when we show up.”

He said every legitimate fire official will schedule an inspection appointment in advance. When the arrive to the scene, they are to have a marked department vehicle, badge, uniform and a form of identification. Caven said the suspect had none of those items.

Officials said if you receive an unexpected visitor, call the agency they say they are from to confirm their identity before allowing them access to sensitive areas. To confirm the identity of a public safety employee outside the office’s regular business hours, you can call the non-emergency line at 541-682-5111.

Redesigned COVID-19 Daily Data Dashboard: http://ow.ly/WEjB50IBwkh Updated every weekday, the dashboard highlights data from several sources that monitor for COVID-19 trends and links to related dashboards for more detailed information.

Anyone contracting coronavirus in Oregon is now more likely than not to have a hyper-contagious subvariant of the virus that has caused COVID-19 cases to swell in some regions of the U.S.

The BA.2 variant likely accounts for seven in 10 of coronavirus infections reported to the state, according to the Oregon Health Authority. Meanwhile positive tests have increased in the mid-valley.

Cases reported to the state and positive tests for the virus continued to increase, then plateau by April 5, when Oregon logged 354 cases. That number increased from case rates less than 300 in March but well below the Jan. 8 peak, when 9,626 cases were reported to OHA.

Test positivity, an early indicator for future cases, hospitalizations and COVID-19-related deaths, increased from 2.5% on March 13, a day after the state lifted mask requirements, to 2.9% by March 27.

We want to keep you informed about COVID-19 in Oregon. Data are provisional and change frequently. Note: This week’s Omicron BA.2 estimate of 100% is higher than expected due to a small number of specimens (n=7) available in GISAID during the most recent week. We do not believe this estimate to be accurate. CDC’s COVID Data Tracker Nowcast model (ow.ly/nywv50ICsbO) estimates that approximately 58% of SARS-CoV-2 variants circulating in the US during the last week were the Omicron BA.2 lineage. We believe our true Omicron BA.2 estimate to be similar to the national figure. For more information, including COVID-19 data by county, visit our dashboard: ow.ly/S3nx50ICsho

OHA releases new COVID-19 data — Oregon has seen an increase in daily reported cases of COVID-19 for the most recent reporting week following more than two months of steady declines, Oregon Health Authority (OHA) reports today. The number of COVID-19 tests was also substantially higher, with a small increase in percent positivity.

Hospitalizations continue to steadily decline, falling to weekly levels last seen in early July 2021. The number of COVID-19-related deaths — typically a lagging indicator — was higher for the week ending April 3 than the previous weekly reporting period that ended March 27.

Oregon Garnishes Millions In Tax Refunds To Collect Old Unpaid Tickets And Court Fees

Tens of thousands of Oregon taxpayers have had money garnished from their state tax refunds due to a little-known program that allows the state to collect old unpaid debts, such as parking tickets or court fees.

The impact of this state program has fallen disproportionately on poor and minority communities.

Each year, the Oregon Department of Revenue collects roughly $27 million in unpaid debt on behalf of dozens of state agencies and local governments. The Oregon Judicial Department (OJD) is the largest user of the program, extracting nearly $8 million annually in delinquent fines and fees.

From 2019 to 2021, approximately 61% of the tax refunds intercepted within Multnomah County on behalf of state courts were intended for residents in zip codes where the median household falls below the county’s overall median household income of $71,425, according to Census Bureau data.

Roughly one-third of the tax-refunds intercepted in Multnomah County for unpaid tickets or court fees came from just five zip codes. Those neighborhoods — including Centennial, Outer Southeast, Wilkes/East Portland, Lents and Gresham – have some of the lowest median incomes in the county and highest non-white populations.

Unpaid parking tickets, court fines and fees often bounce between private debt collectors and the court for years before tax returns are garnished. In Oregon, this unpaid debt doesn’t come off the books for 20 years.

Low-income individuals and families depend on annual tax refunds as a financial safety net, advocates argue. “It’s almost like it is set up to keep people in their poverty status and from moving forward,” said Aliza Kaplan, law professor at Lewis and Clark and director of the Criminal Justice Reform Clinic.

Last year, an estimated 68,000 Oregonians did not receive their full tax returns because the state intercepted the money to pay off debts, according to revenue department records. At the same time, state economists announced a huge budget surplus.

In Oregon, debtors can enter payment plans to pay off fines and fees but if they miss payment or if the debt becomes delinquent, then their state tax refunds may be seized.

The money collected for traffic and parking violations is split between the state and agency which issued the ticket.

Multnomah County Circuit Court has $395 million in unpaid court debt on the books, and the balance grows every year. In 2021, the court recovered just a small fraction of that total — roughly $1 million in unpaid debt by garnishing tax refunds.

The true cost of collecting court fines and fees is difficult to measure — both in financial terms and the burden for those who owe.

Oregon’s Chief Justice and Judicial Department have acknowledged court fines and fees are an issue that should be addressed.

“We will continue to examine the impacts of fines and fees, develop best practices for their imposition and take affirmative steps to ensure that they do not create unnecessary barriers or disproportionate outcomes,” explained the OJD strategic plan for 2020-21.

The Judicial Department has worked with the state legislature and within its own authority to help alleviate the impact of fines and fees, according to a OJD spokesperson.

Over the past few years, the court ended the practice of suspending driver licenses for unpaid fines, temporarily paused collections during the pandemic (since restarted), offered payment plans and extended the time before accounts are sent to collections.

Criminal justice reform advocates argue, there are options including an amnesty program — which would allow people with unpaid tickets the opportunity to pay ticket balances without having to pay the additional late fees that have accumulated. Additionally, some jurisdictions have explored a mandatory statute of limitations where tickets could be dismissed after a certain period and deemed uncollectable.

Advocates argue tax refund garnishment is particularly harmful because they don’t have protections for low-income residents.

“It’s really important to realize that there is a segment of our population who will never be able to pay,” explained Kaplan. “We need a better way to handle it.”

State continues paying applications after the Oregon Emergency Rental Assistance Program closed last month

More than 48,000 Oregon households facing pandemic hardship receive over $319 million in rental assistance relief

SALEM, Ore. — Oregon Housing and Community Services (OHCS) is processing for payment applications submitted through the Oregon Emergency Rental Assistance Program (OERAP) which stopped accepting applications on March 21. As of April 6, the agency has paid out $319.2 million in emergency rental assistance to 48,371 households.

Applications are being approved for payment or denied based upon the highest need, not on a first-come, first-served basis. Applicants can continue to log on to the OERAP portal to check the status of their application. They will be alerted by email as their application advances.

Five counties and the city of Portland received allocations from the U.S. Department of the Treasury and are running their emergency rental assistance programs. Tenants can contact their local community actions agencies to inquire about additional available rental assistance resources. Renters can also call 2-1-1 or visit oregonrentalassistance.org for additional information.

Tenants who submit new applications to the local programs can access protections from eviction for nonpayment of rent while their application is being reviewed and processed. Tenants must show proof to their landlord that they applied for the program to receive the protections. Tenants at immediate risk of eviction should apply for rental assistance right away to access safe harbor eviction protections and contact a legal organization:

- Oregon Law Center’s Eviction Defense Project: 888-585-9638 or evictiondefense@oregonlawcenter.org

- Oregon State Bar: 503-684-3763 or legalhelp@oregonstatebar.org

WorkSource Oregon Hosts Series of Job Fairs in April

The Oregon Employment Department and its WorkSource Oregon partners continue to help workers find good jobs and employers find talented employees.

WorkSource Oregon centers across the state are offering job fairs and events across the state. Here are a few highlights of upcoming WorkSource Oregon hiring events:

- Bend – “Spring Hiring Fair,” April 26, 11 a.m.-2 p.m. at Troy Field

More than two dozen employers from various industries throughout Central Oregon will be ready to hire at the “Spring Hiring Fair.” Job seekers and interested community members are invited to attend. They should bring resumes and expect to be interviewed on the spot by employers. Employers come from industries such as healthcare, construction, manufacturing, information technology, technology, public sector, education, and nonprofit.

- Marion, Polk and Yamhill counties – Virtual “Meet the Employer”

for the Oregon Department of Human Services, April 20, 12-1 p.m.

The Oregon Department of Human Services is hosting a virtual “Meet the Employer” event. From entry level to experienced and supervisory-level jobs, the agency has a variety of positions open in its Self-Sufficiency and Child Welfare programs in Marion, Polk and Yamhill Counties, including office support, benefits and eligibility specialists, and case workers.

- Medford – “Rogue Valley Careers in Gear,” April 27, 3-6 p.m. at the Jackson County Expo Center

More than 100 local careers will be represented in the “Rogue Valley Careers in Gear” event on April 27. Employers will accept applications on the spot. Attendees are encouraged to bring their resumes and prepare for success!

The Oregon Employment Department (OED) is an equal opportunity agency. Everyone has a right to use OED programs and services. OED provides free help. Some examples are sign language and spoken language interpreters, written materials in other languages, braille, large print, audio and other formats. If you need help, please call 971-673-6400. TTY users call 711. You can also ask for help at OED_Communications@employ.oregon.gov

El Departamento de Empleo de Oregon (OED por sus siglas en inglés) es una agencia de igualdad de oportunidades. Todas las personas tienen derecho a utilizar los programas y servicios del OED. El OED proporciona ayuda gratuita. Algunos ejemplos son intérpretes de lenguaje de señas y lenguaje hablado, materiales escritos en otros idiomas, braille, letra grande, audio y otros formatos. Si necesita ayuda, llame al 503-947-1444. Los usuarios de TTY pueden llamar al 711. También puede solicitar ayuda en OED_Communications@employ.oregon.gov.

Visit our website at worksourceoregon.org

Umpqua Bank Crowdfunding Partnership Accelerates No-Cost Financing for Oregon BIPOC, Women Entrepreneurs

Bank encourages eligible entrepreneurs needing access to capital to apply for 0% financing up to $15,000. Provides a triple dollar match for business owners across four states

Umpqua Bank, a subsidiary of Umpqua Holdings Corporation (NASDAQ: UMPQ), has officially activated its $1 million Umpqua Bank Managed Loan Fund with Kiva, a nonprofit unlocking capital for historically underserved entrepreneurs and their communities.

Through Kiva’s innovative crowdfunding microloan platform, Umpqua is providing eligible BIPOC and women entrepreneurs across its footprint accelerated financial support towards a 0% interest loan up to $15,000 to finance their emerging business.

Leveraging Kiva’s crowdfunding platform, qualifying business owners in Oregon, Washington, California, and Idaho will receive a triple match from Umpqua for every dollar raised for their business from family, friends, and supporters in their communities.

Umpqua is encouraging entrepreneurs in communities it serves to learn more about Kiva and apply for funding.

“Our partnership with Kiva makes it possible for more entrepreneurs to turn support from their communities into a source of capital that would otherwise not be available,” said Umpqua’s Chief Marketing Communications Officer Eve Callahan. “If individuals believe in and are willing to help finance a local BIPOC or women entrepreneur, Umpqua will triple the amount of their financial support so enterprises can more easily and quickly access the financing they need.”

How Kiva Works

For any business owner in need of funding to start, sustain or grow, the only collateral needed to access capital through Kiva is the support of the people and community they serve. Typical barriers to access are removed from consideration, including those related to credit history, physical assets for collateral, citizenship or verifiable financial track record.

Kiva works hand-in-hand with entrepreneurs to set a financing goal up to $15,000 and raise contributions from friends, family, and community members on its platform. Kiva also offers access to a global network of lenders interested in supporting businesses. Financial commitments raised are then combined into a 0% interest business loan eventually repaid to supporters over three to five years.

Umpqua, through the Umpqua Bank Managed Loan Fund, will help BIPOC and women entrepreneurs reach financing goals more quickly by effectively quadrupling every dollar they raise towards their financing goal.

How to Apply

To apply for Kiva financing and the triple dollar match through the Umpqua Bank Managed Loan Fund, entrepreneurs in Oregon, Washington, California, and Idaho can visit the Umpqua-Kiva partnership page. The initial application process typically takes between 20 and 30 minutes.

The Kiva partnership is part of Umpqua’s Small Business Empowerment Program, which brings together the bank’s various initiatives to improve access to funding, products/services and expertise under one strategic umbrella. Along with Kiva, the Small Business Empowerment Program includes partnerships with organizations that are often the first step for entrepreneurs interested in accessing Kiva funds, including: Oregon-based MESO (Micro Enterprise Services of Oregon); Washington-based Business Impact NW; and California-based Centro Community Partners.

“We are excited to partner with Umpqua Bank as part of its Small Business Empowerment Program to provide additional loans and unlock capital for under-resourcedentrepreneurs,” said Sarah Marchal Murray, Chief Strategic Partnerships Officer at Kiva. “Ensuring every business owner has equal access to capital and other resources to succeed is important for creating strong and vibrant communities. Partnering with Umpqua, Kiva is honored to extend our platform’s reach to more communities across the West Coast.”

About Umpqua Bank

Umpqua Bank, headquartered in Roseburg, Ore., is a subsidiary of Umpqua Holdings Corporation, and has locations across Idaho, Washington, Oregon, California and Nevada. Umpqua Bank has been recognized for its innovative customer experience and banking strategy by national publications including The Wall Street Journal, The New York Times, BusinessWeek, Fast Company and CNBC. The company has been recognized for eight years in a row on FORTUNE magazine’s list of the country’s “100 Best Companies to Work For,” and was recently named by The Portland Business Journal the Most Admired Financial Services Company in Oregon for the seventeenth consecutive year. In addition to its retail banking presence, Umpqua Bank also owns Financial Pacific Leasing, Inc., a nationally recognized commercial finance company that provides equipment leases to businesses.

About Kiva

Kiva is a global nonprofit that brings people together to invest in lasting impact. Kiva connects individuals, institutional investors, and corporations with global opportunities to invest in humanity—when and where it will make the greatest collective impact. With as little as $25, you can help women, refugees and small businesses across the globe build a better future for individuals, their families and communities. Join two million people who have invested $1.7 billion in real dreams and real opportunity around the world.

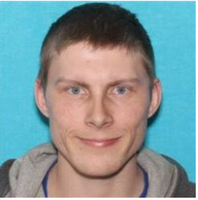

Grants Pass Missing Person

The Grants Pass Police Department is seeking assistance from the public in locating 30 year old Noah Baker. Baker was despondent after an argument and left his residence in Grants Pass driving a silver Ford Fiesta with Oregon Plate 671MUR.

Baker is described as a white male adult, 5’09”, 170 lbs, brown hair and blue eyes and was last seen wearing black sweats, black shirt, black shoes and a black hat.

If anyone knows of his whereabouts or sees Baker, please call your local law enforcement agency or the Grants Pass Police at 541-450-6260. Reference case #2022-14203 Grants Pass Police Department

Klamath County Sheriff’s Office Asks for Public’s Help in Search For Trucker Suspect

The first real clue to come in on all the missing person cases in the area. Help Klamath Falls Oregon Sheriff Office ID this trucker. He was the last to see this woman alive and could be the key to not only solving this woman’s disappearance but a number of the hundred other women missing in PNW. IF you have any information, please call (541) 883-5130

https://www.facebook.com/pg/Have-You-Seen-Me-Southern-Oregons-Missing-People-161249961222839/posts/